In this article, we will look at an example based on the previous explanations. Suppose that there is an operating lease lessee as follows:

【Example】

A 5-year real estate lease is determined to be an operating lease.

The commencement date is 1/1/20X1.

The rent is payable annually: $5,000 on the commencement day, followed by the next year’s rent by the end of the previous year, $10,000 in the second year, $20,000 in the third year, $30,000 in the fourth year, and $40,000 in the fifth year.

The rent includes CAM (common area maintenance), and the ratio of rent to CAM stand-alone price is 9:1.

In addition, the lessee pays $1,000 to the broker at the time the contract is signed.

The implicit rate is not readily available.

【Accounting Policy】

The discount rate applied to lease payments is the risk-free rate, not the incremental borrowing rate. The risk-free rate is 4% at the commitment date.

Lease components and nonlease components are accounted for as separate items, instead of using the practical expedient (see Part 5), which makes no distinction between them.

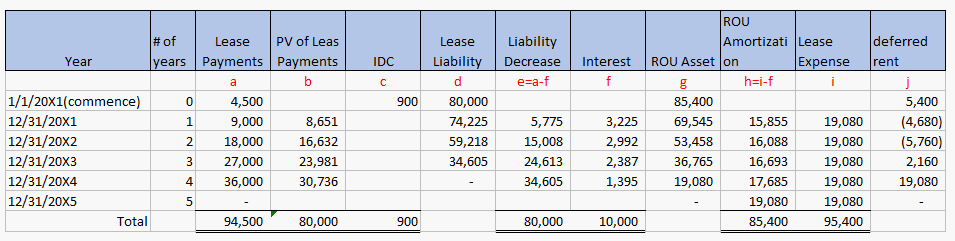

The following table shows the amounts of lease-related accounts for each year according to the above example.

(Table I)

Separation of lease component and non-lease component

First, separate the lease component from the nonlease component. In the example, the ratio of the stand-alone price is 9:1, so the payment is separated into 90% for the lease component and 10% for the non-lease (CAM) component. In this case, the IDC (initial direct cost) of $1,000 is also separated. If a practical expedient is used, separation is not necessary, but the lease liability and ROU asset will be larger.

After the separation, the lease liability and ROU asset are calculated.

Calculation of Lease liability

col. b is the PV (present value) of the amount in col. a discounted to 4% over the period from 1/1/20X1. Previously, lease liability was explained as follows:

Lease liability is the present value of the lease payments not yet paid, discounted using the discount rate as of the commitment date. In the example, the amount of rent for years 2 through 5 to be paid at the end of years 1 through 4, discounted at 4%, is $80,000, which is the lease liability (col. d) as of 1/1/200X1.

Calculation of ROU asset

On the other hand, ROU asset was explained as follows

At the commencement date of the lease: ((present value of lease payment not yet paid = lease liability) + (lease payment already paid) + (initial direct cost)

In the example, this would be $85,400 ($80,000+$4,500+$900) (col. g).

Interest-Equivalent Portion and Reduction of Lease Liability

The next step is to calculate the interest component.

The interest component is the unpaid lease liability multiplied by the 4% interest rate (col. f). The lease liability is reduced (col. e) by the amount paid (col. a) minus the above interest component (col. f), and the lease liability is reduced to zero at the end of the fourth year when the fifth year’s rent is paid (col. d).

Lease expense and amortization of ROU asset

After the interest portion, calculate the lease expense and the amortization of the ROU asset. Lease expense calculated by allocating the payments equally over the lease period. In the example, ($94,500+$900)/5=$19,080 (col. i); the amortization of the ROU asset is the amount of the lease expense less the interest portion (col. h). This completes the table, but there is a difference between the release liability and the ROU asset. The structure is analyzed below.

Difference between Lease liability and ROU asset

As mentioned in Part 7, the lease liability calculation does not take into account the lease payment or IDC (initial direct cost) paid to the lessor before or at the beginning of the lease, so there is a difference between the lease liability (col. d) and the ROU asset (col. g). This difference includes: 1) the difference between the ROU asset, which is amortized in a way to smooth out the fluctuating rent, and the lease liability, which is calculated by the PV of the remaining obligation, and 2) the difference between the first payment that is paid by the commencement date of the lease and added to the ROU asset and the unamortized portion of IDC (initial direct cost).

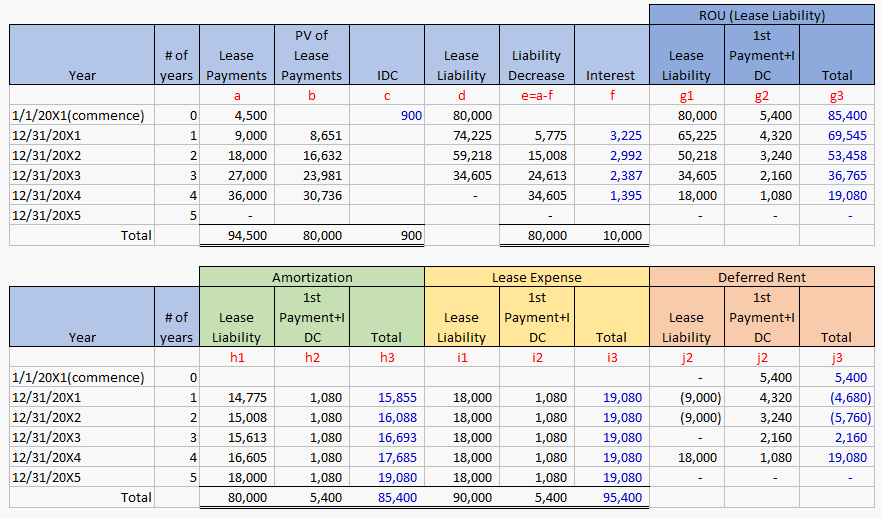

Since this is a little difficult to understand, we have broken down the following two parts: 1) the lease payment, which is paid after the commitment date and is used to calculate the lease liability, and 2) the portion paid before the commitment date and not subject to the PV calculation. The following is a breakdown of the two parts of the PV calculation.

The table is stacked at the bottom because it is too long horizontally.

(Table 2)

The ROU asset corresponding to part (1) is = lease liability = $80,000 (col. g1). This RUA will be amortized by the difference between the levelized release expense of $18,000 per year (col. i1) and the interest portion of each year (col. f) (col. h1).

On the other hand, the ROU asset corresponding to part (2) will be = $5,400 (col. g2), which will amortized at equal amount of $1080 for each year (col. h2),. Note that the ROU asset corresponding to part (2) is reduced by the same amount as the lease expense because it was paid before the commitment date and there is no interest component.

The sum of part (1) and part (2) results in ROU asset = col. g3, which is the same as g in Table 1. Similarly, col. h3 is equal to col. h in Table 1, col. i3 is equal to col. i, and col. j3 is equal to col. j.

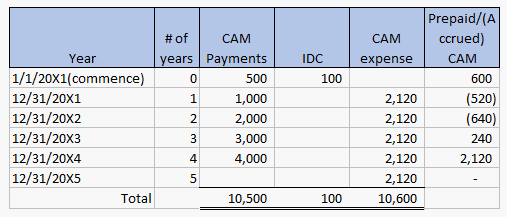

Non-lease Component Treatment

(Table 3)

Now we get to the next question: how is the non-lease component (CAM in this example) treated? First, as mentioned above, 10% of the payment is treated as payment for the CAM, and 10% of the IDC is treated in the same way. The CAM portion of the payment is $10,600 until the end of the 5th year of the lease, and the same amount is expensed annually on a levelized basis as the lease expense. In the example, $2,120 ($10,600 divided by 5) is recorded as CAM expense each year.

In addition, for the non-lease component, the present value of future payments is not required to be recorded as a liability. Therefore, the difference between the cumulative amount of CAM expense and the cumulative amount of payments is only recognized as prepaid CAM or accrued CAM.

In the next issue, we will explain how to choose a risk-free rate, which is a practical problem and has been asked a lot recently.